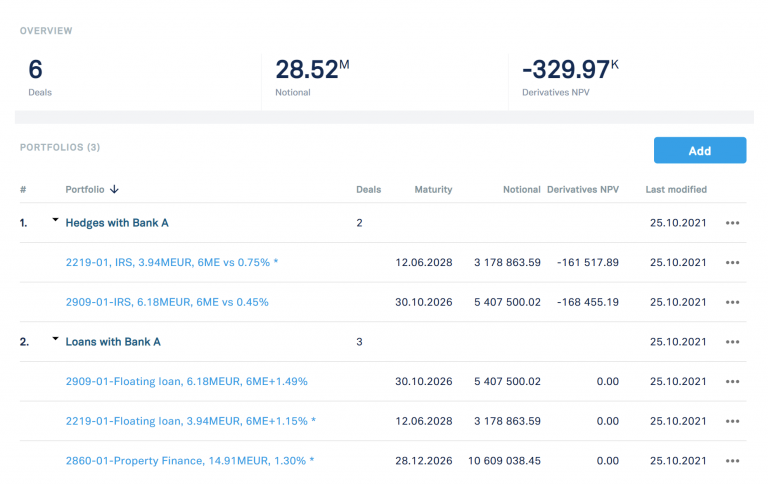

Scenario analysis for interest rate derivatives portfolio

- Without tools:

- capturing derivatives in spreadsheets takes forever

- simulating market states requires expert knowledge

- wasting time&budget on complex market data licences

- #REF error ruins months of work

- operational risk when macro-savvy employee leaves

- static on-prem system of records

- With Treasuryview:

- re-use our deal templates capturing derivatives in seconds

- automated market state scenarios, risk views and lifecycle events

- pre-integrated market data automations

- street tested calculation and treasury dashboard engine

- limited key person risk via auditability and team collaboration

- cloud access with up and downstream data sync

Easy Signup. No payment method needed. Your trial expires automatically.

Contact us

Our team is enthusiastic about learning how we can assist you in effectively managing your financial risks on a daily basis. We’re happy to hear from you. Fill in the form below and we’ll be in touch soon.

Back Main page /

Zurück zur Hauptseite