THE CORPORATE TREASURER-FIRST TMS

Treasury and Risk Management

with self-service ease.

Debt, derivatives, interest rate and FX risk exposure analysis and management can be complicated, but your software doesn't need to be.

Empowering treasury teams. Powering the Office of the CFO.

INTEREST RATE UNCERTAINTY,

MEET RISK MANAGEMENT

Know your funding data, uncover interest rate hedging ideas, and deliver recommendations to your management in seconds.

Easy Sign-up. No credit card.

Your trial expires automatically

The Future of TMS is Treasurer-first

Rate hikes, rate cuts, shock events- when you, as a treasury manager, want to avoid the unease from "surprise losses," you turn to pro-level spreadsheet analysis, only to get frustrated with time-consuming manual work and missing market data needed to understand the financial impact

before and when the markets move.

Alternatively, during your free trial, you can "wrap" what you currently have with our risk engine, transactions and market data automations, and suddenly, everything in the Office of the CFO immediately turns green and stays green, allowing you to focus on scouting strategic technology for treasury and risk management.

LOANS, FX AND DERIVATIVES

INTEGRATED MARKET DATA AUTOMATIONS

Predictive insights

OUR DATA AND CALCULATION OUTCOMES SYNC PERFECTLY WITH YOUR FINANCE APPLICATIONS.

Key features

TreasuryView™ is the new focal point for treasury risk management on autopilot.

Cut complexity with automations

Loans, renewals and interest rate derivatives, all in one platform

Our debt and interest rate risk management platform enables automated debt portfolio management and risk forecasting, delivering critical insights to management and other important stakeholders at the speed of now. Effectively manage your bank loans, renewals and interest rate hedging products across all of your banking relationships, enterprise structure, and tech stack.

Know what is exposed!

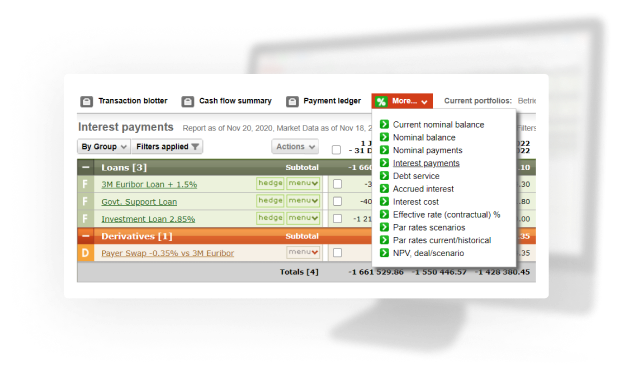

Identify risk exposures and monitor market value changes

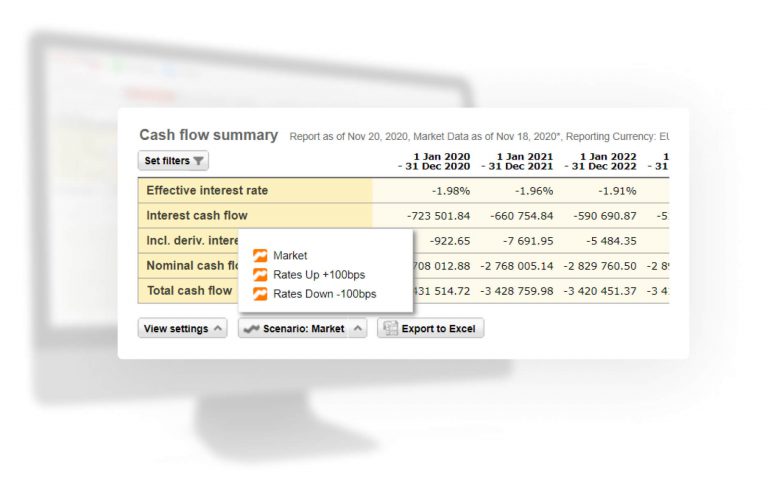

Are your loans and hedging strategies keeping up with the changing markets? Forecast cash-flows from corporate loans and interest rate hedges. Understand strategy outcomes across different financial markets states. Our platform comes with market data pre-integrated.

Hedging strategy simulation

Model hedging strategy outcomes with integrated market data

Keen to understand what happens if existing loans or future borrowings are hedged vs doing nothing? Gameplan different hedging strategies!

TreasuryView™ helps you to link loans and future cash-flows with hedging options, before markets open. Connect with banks, brokers or treasury advisors to make the trade happen

Confident hedge decisions

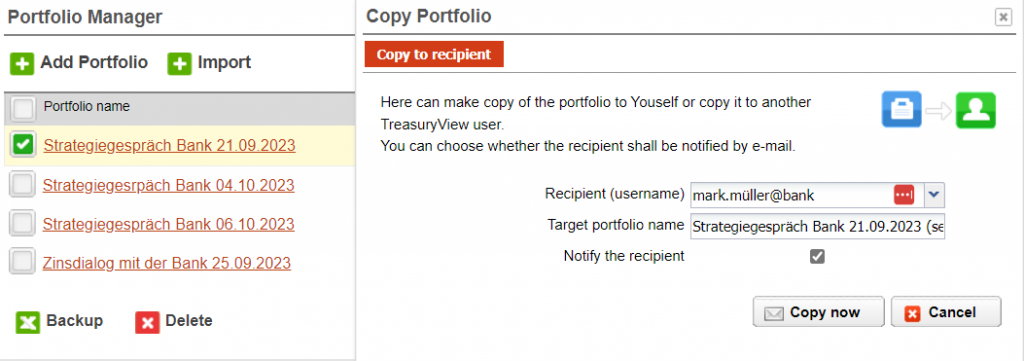

Your favourite hedging strategy,

best outcomes during bank meetings

With Treasuryview you can set-up individual funding or hedging strategies for every bank meeting. Seamlessly simulate and adjust hedging instruments parameters with your bank rep. Furthermore, you can conduct bank meetings interactively and discuss your ideas.

Treasury management in self-service

Immediate success in self-service without waiting for the end of treasury management software implementation project. Automated management of loans, renewals and interest rate hedging programs at cloud speed.

Automated treasury risk insights

Understand risk and strategy outcomes across different business states by leveraging easily customizable reports, with no delay.

Results up to date with market data

Near- or realtime market data keeps your instrument values and forecasted cash-flows up to date

Accelerate change with trusted partners

Our friends and partners assist CFO offices of all sizes in achieving success and better results faster.

Deepen your understanding of financial management

At TreasuryMastermind.com, we have created a dedicated online space tailored for corporate treasurers and individuals interested in the intricacies of cash management, global payments, foreign exchange (FX), corporate finance, and risk management. Our platform serves as an inclusive and dynamic forum, fostering open discussions, collaboration, and knowledge-sharing within the treasury and financial community.

World class treasury expertise

We at pecuniatf.nl, offer a complete service on all financial issues that a company faces.Thanks to our many years of expertise in the field of treasury & finance, we are experts and are convinced that we can offer added value.Finally, a good treasury management will lead to a decrease of financial risk and can even lead to extra returns.

The next generation of risk intelligence

We at Hedgego offer AI-based support for hedging risks arising from foreign currencies or price developments. If price risks in transactions/projects are treated individually and in isolation, it is sometimes not possible to find an economically sensible approach to risk hedging.

FX decision data: Hedgego balances your cash flow at risk with your value at risk based on profound automated FX market analysis.

Single Risk Proxy: identification of the risk in the underlying transaction by means of a risk index make it possible to calculate a proxy index that counteracts the risk (has a risk-compensating effect).

Portfolio Proxy: The aggregation of several risks into a single risk unit allows the calculation of a proxy index that is able to economically counteract the overall risk as a valuation unit

Imagine how much more you could do if you had a treasury management system simplifying your daily tasks 10x?

We have added few practical guides and walkthroughs on how to unite banking transactions into secure digital repository, manage and oversee corporate loans and interest rate derivatives, understand hedging options, anytime when underlying business or markets change.

Featured instrument coverage

Term loans

Variable loans

ANNUITY LOANS

Featured instrument coverage

INTEREST RATE SWAPS

CAP/FLOOR/COLLAR

SWAPTIONS

Featured instrument coverage

INTEREST RATE SWAPS

CAP/FLOOR/COLLAR

SWAPTIONS

Learn more about debt and interest rate risk management use cases for commercial real estate companies (CRE debt management), public finance teams and local governments and start-ups.

Pricing

TEAM

debt and vanilla derivatives, monthly invoicing, cancel anytime

-

single currency: EUR (check multi-currency add-on)

-

24h delayed market data

-

Deal cap=100 loans and IR derivatives

-

5 internal user (Treasurer,CFO-office,Accounting)

-

1 organization/company

-

E-mail/Teams/Zoom support

-

all prices are net plus VAT (if applicable)

ENTERPRISE

ADD-ON functionality, multi-asset debt, investments, fx, vanilla and structured derivatives or enterprise wide implementations (ask sales)-

currency management (USD,GBP,CHF,etc.)

-

additional swap and reference rate data

-

additional deal volume plan

-

additional internal and guest user

-

SSO/user enrolment Azure AD

-

Swaption pricing module

-

API developer portal access

-

sync treasury data with ERP

IT and information security

Our clients entrust us with sensitive company data. IT security and data protection has therefor been our top priority right from the start. Yor data is stored in ISO27001 certified data center in Western Europe and managed according to German and EU data security regulations. Furthermore we have appointed external data security officer to oversee and improve our data protection procedures.

CORPORATE LOANS AND INTEREST RATE HEDGES MANAGEMENT

TEAM

monthly billing,cancel anytime-

single currency: EUR

-

24h delayed market data

-

Deal cap=100

-

5 internal user

-

1 organization

-

E-mail/Teams/Zoom support

-

all prices are net plus VAT

You can activate ENTERPRISE plan after your test drive.

No credit card.

ENTERPRISE

Add-on's,monthly upgrade options (ask sales)-

multi-currency (USD,GBP, CHF, etc.)

-

additional swap and reference rates

-

additional deal volume plan

-

additional internal and guest user

-

SSO/user enrolment Azure AD

-

Swaption pricing module

-

API developer portal access

-

sync treasury data with ERP

IT and information security

Our clients entrust us with sensitive company data. IT security and data protection has therefor been our top priority right from the start. Yor data is stored in ISO27001 certified data center in Western Europe and managed according to German and EU data security regulations. Furthermore we have appointed external data security officer to oversee and improve our data protection procedures.

Contact us

Our team is enthusiastic about learning how we can assist you in effectively managing your financial risks on a daily basis. We’re happy to hear from you. Fill in the form below and we’ll be in touch soon.