Use-Case: Easily replacing spreadsheets with interactive treasury dashboards for loans and interest rate hedging instruments

- without tools:

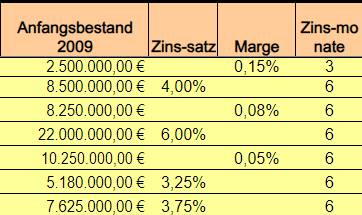

- capturing loans in DIY spreadsheets takes forever

- generating cash-flows requires expert knowledge

- Planning renewals or hedging programs very complex

- wasting time&budget to chase reference rate fixings

- REF error ruins months of work

- operational risk and orphaned data when employee leaves

- static on-prem system of records

- with Treasuryview:

- re-use our deal templates to capture loans in seconds

- automated cash-flow generation, risk views and lifecycle events

- automated renewals and hedging programs on the go

- pre-integrated reference data automations

- reliable and street tested calculation and reporting engine

- limited key person risk via auditability and team collaboration

- cloud access with up and downstream data sync

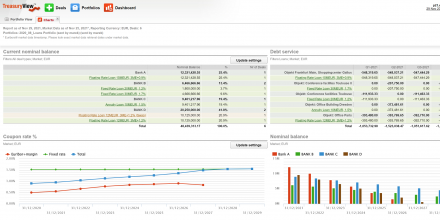

TreasuryView™ dashboard’s provide easily customizable visualizations for your debt and interest rate risk management. You can easily change the dashboard composition or create new treasury dashboard on the go. Additionally, dashboards can be easily shared with other members of CFO office or sent by email.

Play Video

Easy Signup. No payment method needed. Your trial expires automatically.

Contact us

Our team is enthusiastic about learning how we can assist you in effectively managing your financial risks on a daily basis. We’re happy to hear from you. Fill in the form below and we’ll be in touch soon.

Back Main page /

Zurück zur Hauptseite